VA Home Loans: Your Path to Zero Down Payment Home Funding

VA Home Loans: Your Path to Zero Down Payment Home Funding

Blog Article

Comprehending Exactly How Home Loans Can Facilitate Your Journey In The Direction Of Homeownership and Financial Stability

Navigating the complexities of home financings is essential for any individual aiming to achieve homeownership and develop financial security. As we think about these essential aspects, it comes to be clear that the path to homeownership is not simply regarding securing a car loan-- it's regarding making notified options that can form your economic future.

Types of Home Loans

Conventional financings are a preferred alternative, normally requiring a higher credit report score and a down payment of 5% to 20%. These fundings are not insured by the federal government, which can result in more stringent certification criteria. FHA loans, backed by the Federal Real Estate Management, are designed for novice property buyers and those with lower credit rating, enabling for deposits as reduced as 3.5%.

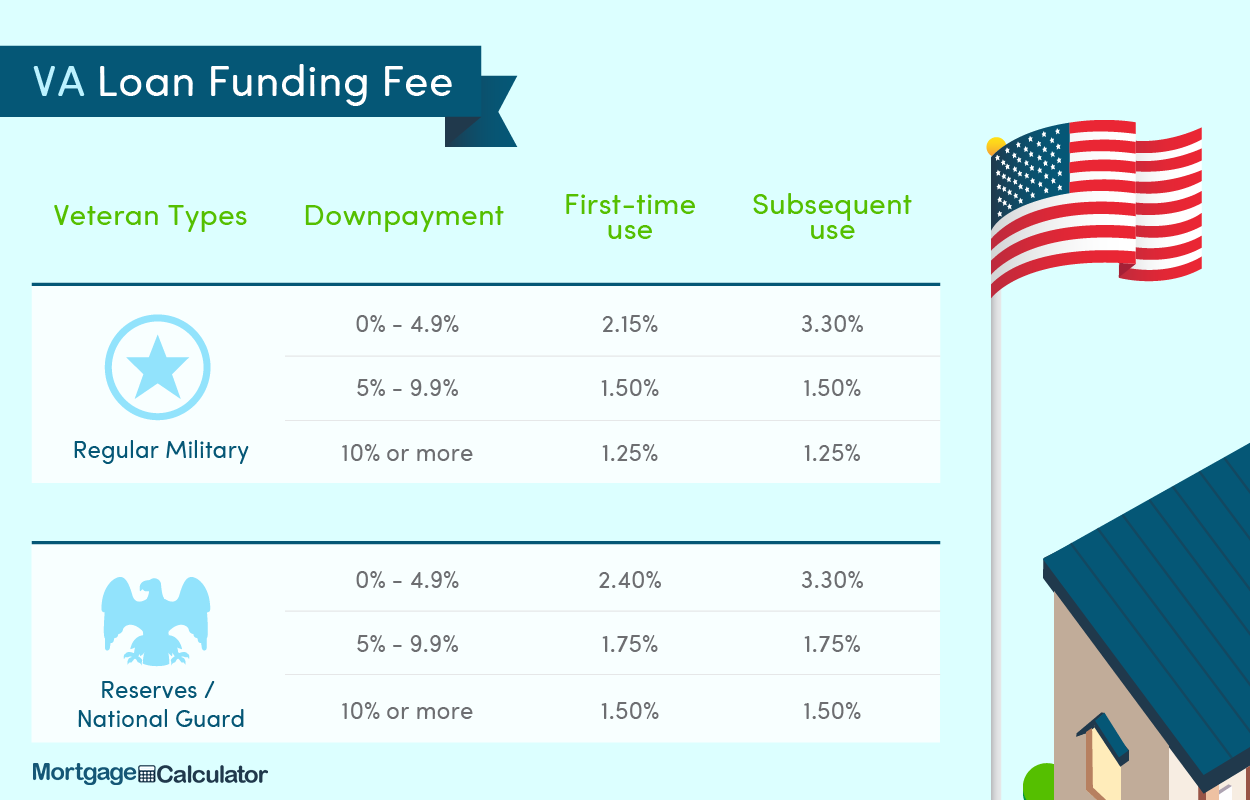

VA financings, available to veterans and active-duty army employees, offer positive terms such as no private mortgage and no down payment insurance policy (PMI) USDA car loans deal with country property buyers, advertising homeownership in less densely populated locations with low-to-moderate revenue levels, also requiring no deposit.

Finally, adjustable-rate home mortgages (ARMs) supply lower preliminary rates that change in time based on market conditions, while fixed-rate home loans provide secure month-to-month settlements. Comprehending these choices enables potential homeowners to make informed choices, aligning their monetary objectives with the most suitable financing kind.

Understanding Rate Of Interest Rates

Rate of interest play a crucial role in the mortgage procedure, dramatically influencing the general price of loaning. They are basically the cost of borrowing cash, shared as a percent of the funding amount. A lower rate of interest can cause considerable savings over the life of the car loan, while a higher rate can lead to raised regular monthly settlements and complete passion paid.

Interest rates rise and fall based on different variables, including financial problems, rising cost of living rates, and the monetary plans of central financial institutions. A fixed rate remains continuous throughout the finance term, giving predictability in regular monthly repayments.

Understanding just how rate of interest rates work is vital for potential house owners, as they straight affect cost and economic preparation. It is advisable to compare rates from various lenders, as even a mild difference can have a considerable influence on the complete cost of the car loan. By maintaining abreast of market patterns, borrowers can make enlightened choices that align with their monetary objectives.

The Application Refine

Navigating the home mortgage application procedure can initially appear challenging, yet comprehending its crucial parts can simplify the journey. The primary step includes gathering required documents, including proof of income, tax returns, and a checklist of possessions and obligations. Lenders require this information to review your economic stability and creditworthiness.

Following, you'll require to choose a loan provider that lines up with your monetary demands. Study various home loan items and passion rates, as these can significantly affect your regular monthly payments. As soon as you choose a lender, you will finish an official application, which may be done online or face to face.

As soon as your application is accepted, the loan provider will certainly issue a funding price quote, detailing the prices and terms related to the mortgage. This critical document allows you to examine your choices and make informed decisions. Efficiently navigating this application procedure lays a solid structure for your journey toward homeownership and monetary security.

Managing Your Mortgage

Managing your home loan efficiently is crucial for maintaining financial health and making certain long-lasting homeownership success. An aggressive method to home mortgage administration entails understanding the regards to your car loan, including rates of interest, payment schedules, and any type of possible charges. Routinely reviewing your mortgage declarations can aid you stay informed concerning your continuing to be equilibrium and repayment history.

Developing a budget plan that fits your mortgage payments is essential. Ensure that your monthly spending plan consists you could try this out of not just the principal and interest but additionally real estate tax, homeowners insurance policy, and maintenance prices. This comprehensive sight will certainly stop financial stress and unforeseen expenses.

Additionally, consider making extra settlements towards your principal when feasible. This strategy can significantly lower the total interest paid over the life of the financing and reduce the repayment period. Refinancing is an additional alternative worth exploring, particularly if rate of interest drop dramatically. It can result in decrease month-to-month settlements or a much more positive financing term (VA Home Loans).

Lastly, preserving open communication with your lender can offer clarity pop over to these guys on alternatives offered need to financial difficulties occur. By proactively managing your home loan, you can boost your monetary security and strengthen your path to homeownership.

Long-Term Financial Perks

Homeownership offers substantial long-lasting economic benefits that extend past mere shelter. This equity acts as a financial property that can be leveraged for future investments or to finance major life events.

Furthermore, homeownership supplies tax obligation benefits, such as home loan interest deductions and real estate tax reductions, which can significantly minimize a home owner's gross income - VA Home Loans. These reductions use this link can bring about substantial savings, enhancing general financial stability

In addition, fixed-rate mortgages safeguard property owners from increasing rental costs, making certain foreseeable regular monthly settlements. This security allows individuals to spending plan successfully and plan for future expenditures, promoting long-term financial goals.

Homeownership additionally promotes a feeling of area and belonging, which can lead to increased civic engagement and assistance networks, better adding to economic health. Ultimately, the economic advantages of homeownership, including equity growth, tax benefits, and expense security, make it a foundation of long-term financial security and wealth buildup for individuals and households alike.

Verdict

In conclusion, comprehending home finances is necessary for browsing the course to homeownership and achieving financial stability. Additionally, reliable mortgage monitoring and acknowledgment of long-lasting economic benefits add substantially to constructing equity and cultivating community interaction.

Browsing the complexities of home fundings is vital for any person striving to attain homeownership and establish economic security. As we take into consideration these crucial aspects, it comes to be clear that the course to homeownership is not simply about protecting a financing-- it's about making educated options that can form your monetary future.

Recognizing how rate of interest prices work is critical for prospective home owners, as they directly affect affordability and monetary planning.Handling your mortgage successfully is necessary for maintaining economic health and making certain long-lasting homeownership success.In conclusion, understanding home finances is crucial for browsing the course to homeownership and accomplishing economic security.

Report this page